Accounting Which Journals Are Used for Receipt on Account

To form the basis for an accounting entry to record the underlying transaction. Closing entry is a journal entry that is done at the end of the accounting period.

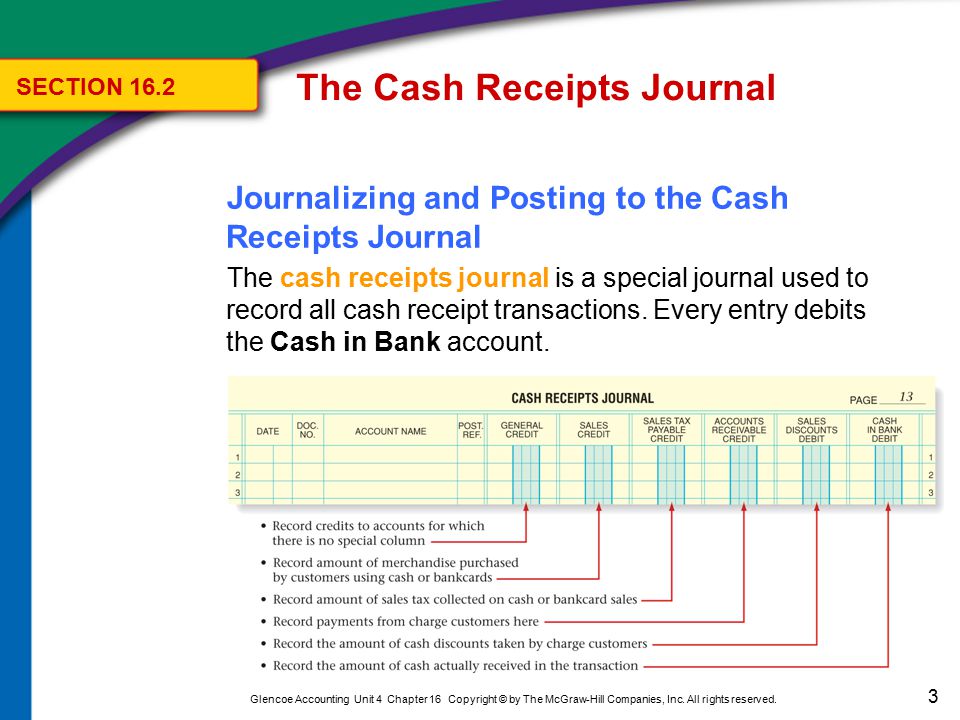

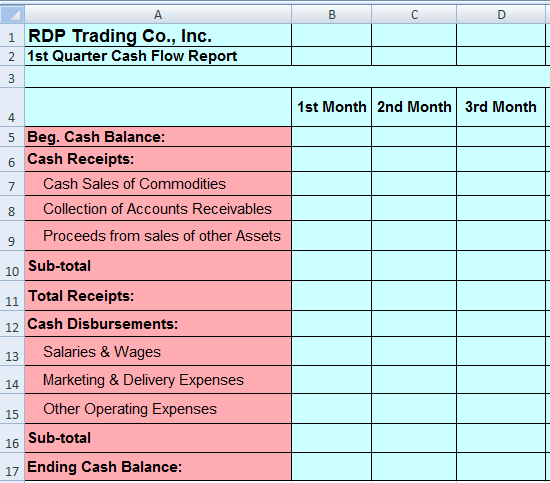

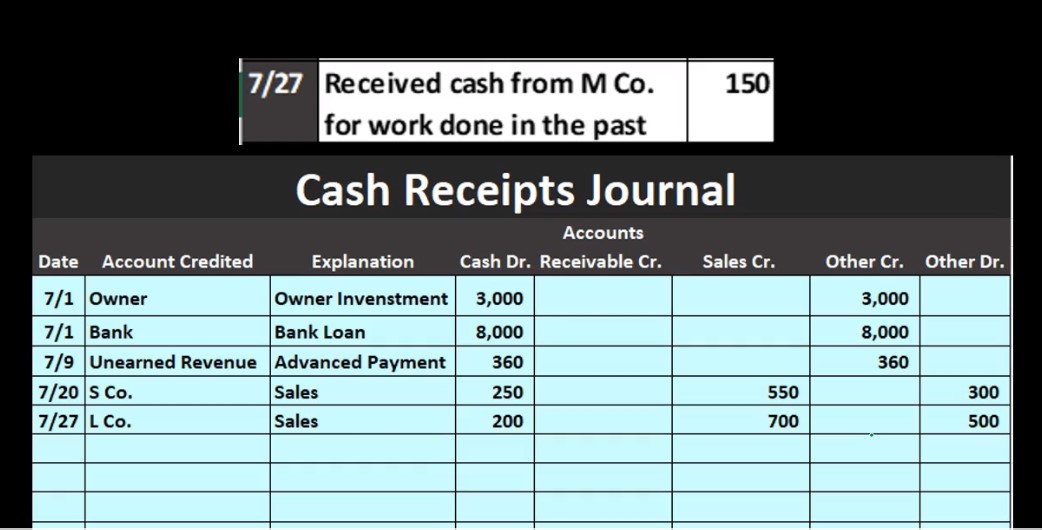

The Cash Receipts Journal Ppt Download

During the time between the invoice being created and delivery of goods there can be a timing difference in.

. A special journal used to record all transactions involving cash receipts or increases is called. This Journal provides information on the balance at the beginning of the period the turnover for the period and the balance at the end of the period for each synthetic account for a certain period. Create accounting distributions for receipts of accrue at receipt purchase orders.

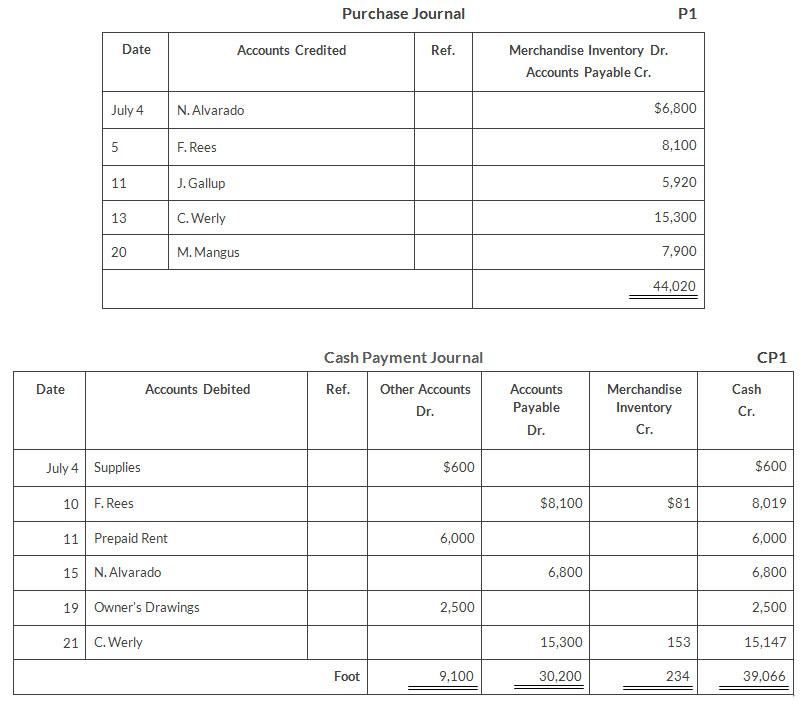

Accounts Payable Journal Entries Example 1 On 5 th February 2019 Sports international ltd purchased the raw material worth 5000 from smart international ltd on the account and promised to pay for the same in cash on 25 th February 2019. Create Receipt Accounting Distributions. Cash payments journal d.

Single-entry accounting is more like using a checkbook than an accounting journal although businesses will still want to keep receipts and the details about their financial transactions. 3 Closing Entry. Apart from the general journal accountants maintained various other journals including purchases and sales journal cash receipts journal and cash disbursements journal.

A journal is the companys official book in which all transactions are recorded in chronological order. A business form giving written acknowledgement for cash received. It includes the following features.

The GRIR the goods receiptInvoice Receipt account is used to post to whenever goods that are not yet invoiced have been received or when invoices arrive b4 the the delivery of goods. The sales journal record all the sales and the payments made in chronological order. One of the most common Journals of synthetic accounting widely used by accountants in the preparation of the balance sheet is the balance sheet.

An accounting journal entry is the method used to enter an accounting transaction into the accounting records of a business. This is cash received from any source - from income a loan received a debtor etc. The receipts and payments account summarizes receipts and payments made by a non-trading concern during a particular period of time usually one year.

Of course these days bookkeepers enter transactions in an accounting program on the computer. Oracle Fusion Receipt Accounting is used to create manage review and audit purchase accruals. Information for each transaction recorded in a journal.

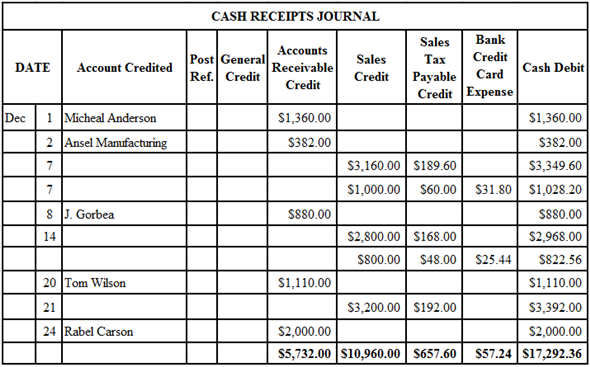

Most businesses use double-entry accounting systems for. The cash receipts journal is a special journal used to record the receipt of cash by a business. They can be used for several reasons including the following.

All cash received by a business should be reported in the accounting records. In every journal entry that is recorded the debits and credits must be equal to ensure. It is also the primary accounting journal.

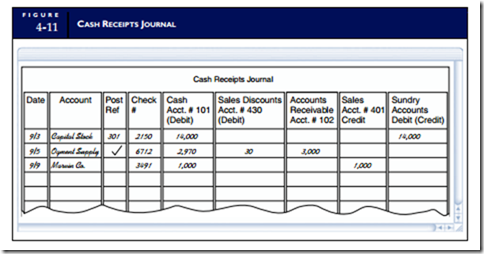

The format of each journal is shown below along with a description. A cash receipts journal is used to record all cash receipts of the business. A journal amount column that isnt headed with an account title.

Examples of journals include the Cash Receipts Journal CRJ and the Cash Payments Journal CPJ. The journal is simply a chronological listing of all receipts including both cash and checks and is used to save time avoid cluttering the general ledger with too much detail and to allow for segregation of duties. To document the transfer of ownership to the buyer.

Before computerized bookkeeping and accounting the transactions were entered manually into a journal and then posted to the general ledger. The Journal Entries that are typically used to record the accounts payable are as follows. So these books of first entry are now just in digital form.

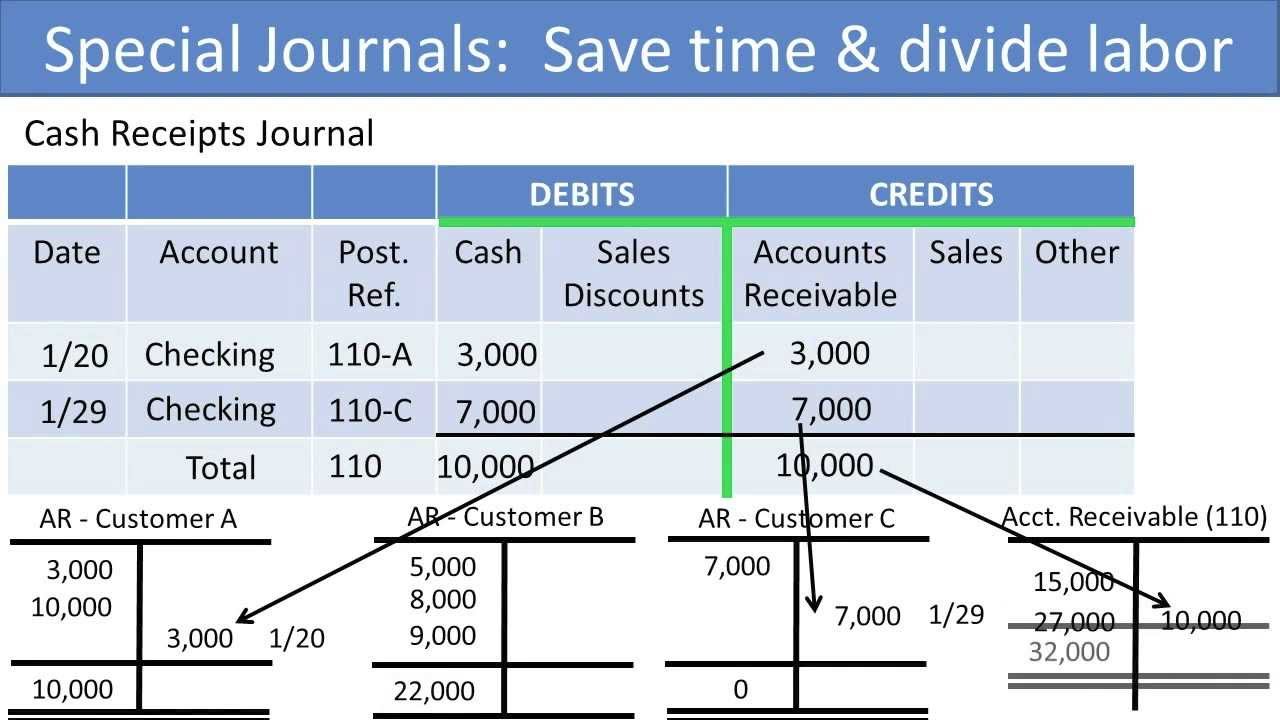

The accounting records are aggregated into the general ledger or the journal entries may be recorded in a variety of sub-ledgers which are later rolled up into the general ledger. As a control so that the buyer has proof of the amount paid. Sales journals are a special type of accounting book which are mainly used to track sales receipts and much more.

Although many companies use accounting software nowadays to book journal entries journals were the predominant method of booking entries in the past. The receipts and payments account is prepared from transactions recorded in cash book and can also be termed as a summarized. Journalize and record business transactions in a general journal andor cash journal.

This type of entry is posted to shift ending to retain earning account from all temporary accounts like loss account gain account expense account and revenue account Revenue Account Revenue accounts are those that report the businesss income and thus have credit. Receipts are usually associated with the delivery of goods or services from a supplier. Its is used to prepare income and expenditure account of non-trading concerns.

Accounting Terms Journals study guide by taitkuip13 includes 13 questions covering vocabulary terms and more. Cash receipts journal b. What is GRIR Accounting Entries and What Journal Entries One Should Pass for This.

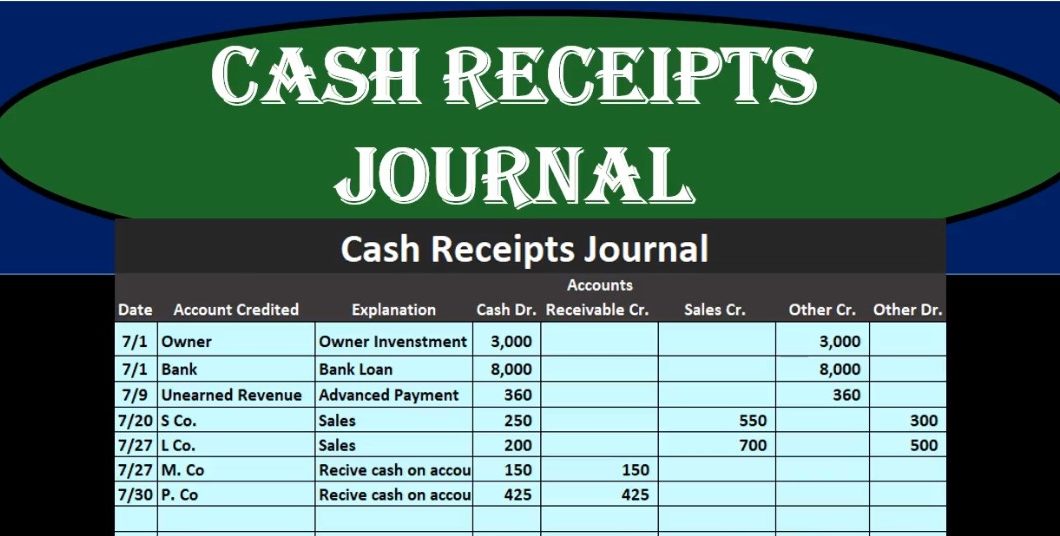

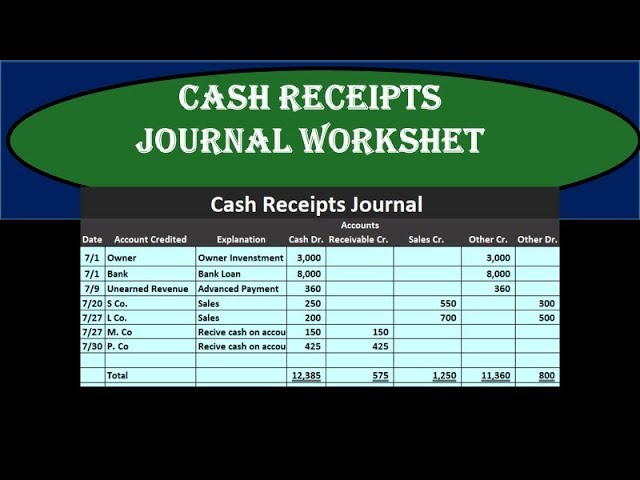

In a cash receipts journal a debit is posted to cash in the amount of money received. Cash Receipts Journal CRJ The cash receipts journal is the journal where you record all cash that has been received. The cash receipts journal is a special journal used to record the receipt of cash by a business.

It used to be an actual book that the bookkeeper would use to make accounting entries. The journal is simply a chronological listing of all receipts including both cash and checks and is used to save time avoid cluttering the general ledger with too much detail and to allow for segregation of duties.

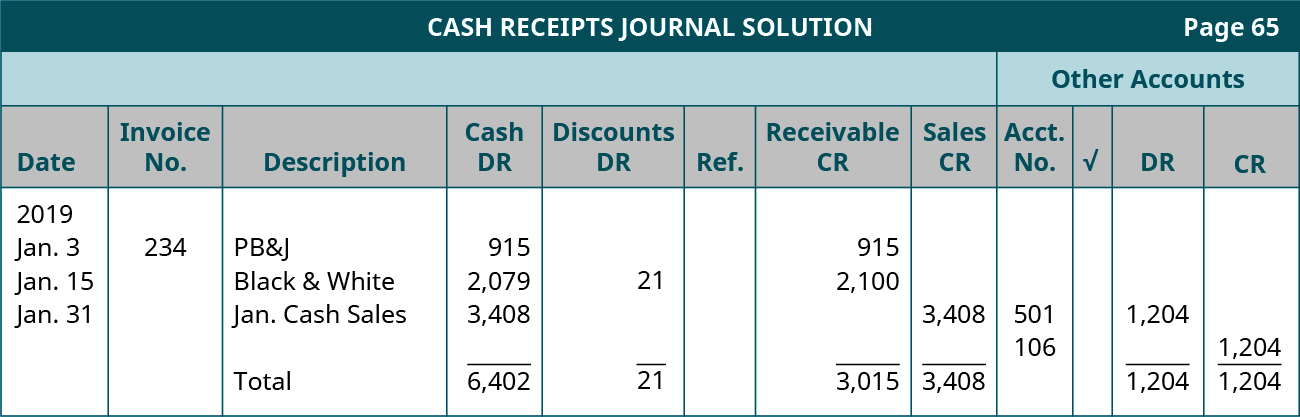

Accounting Information Systems

Bookkeeping Journal In Accounting Double Entry Bookkeeping

Topic 7 Unit 1 Concept Of A Cash Receipts Journal Crj For A Service Business Ppt Download

Cash Receipts Journal Fundsnet

The Cash Receipts Journal Youtube

Solved Cash Receipts Journal Zebra Imaginarium A Retail Business Chegg Com

Special Journals Financial Accounting

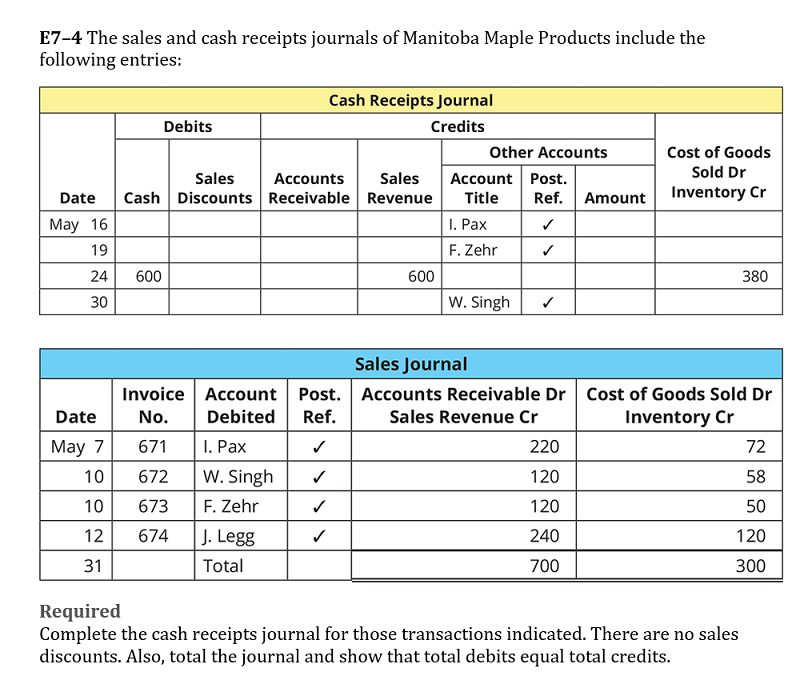

Solved E7 4 The Sales And Cash Receipts Journals Of Manitoba Chegg Com

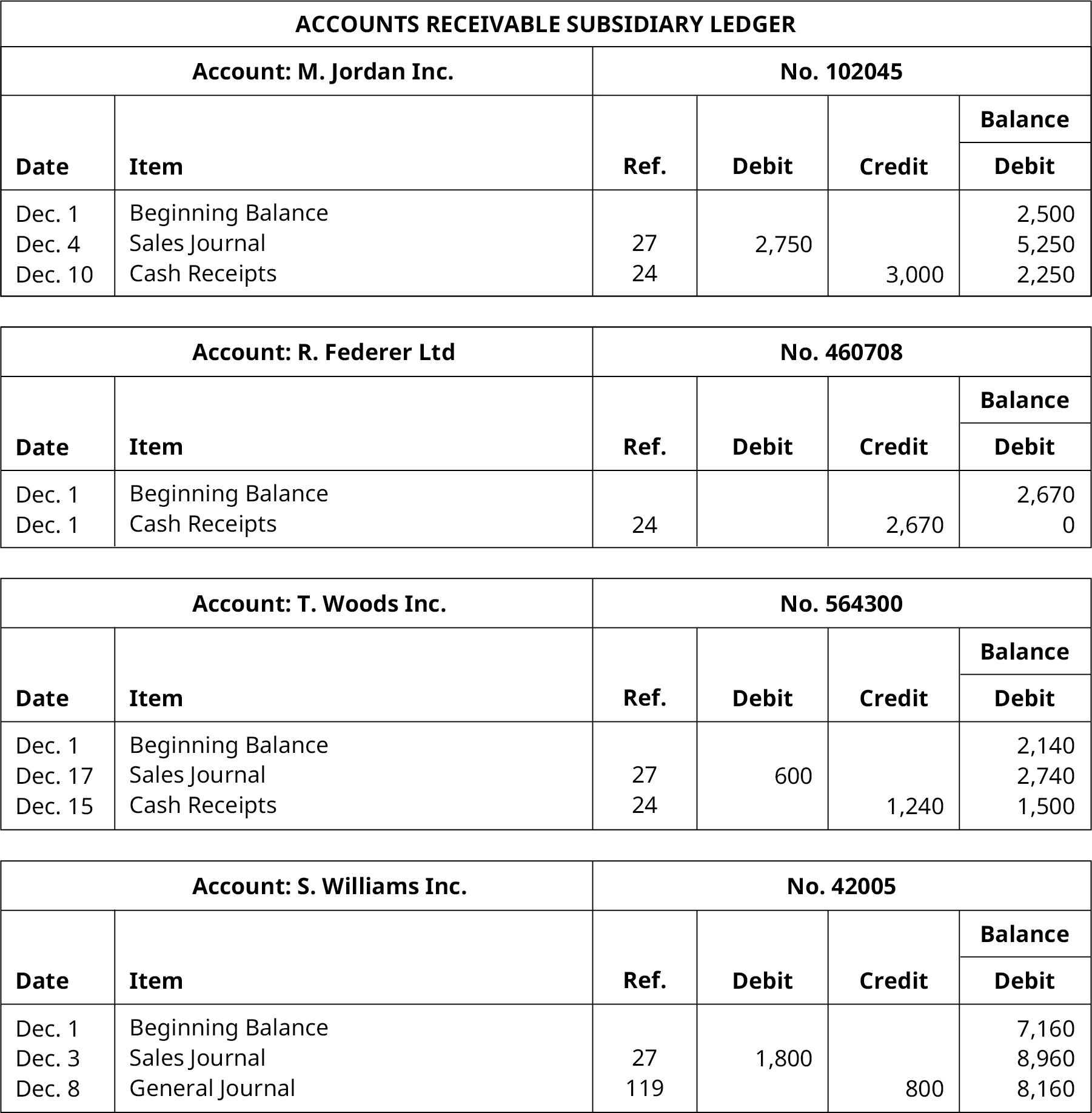

Prepare A Subsidiary Ledger Principles Of Accounting Volume 1 Financial Accounting

Describe And Explain The Purpose Of Special Journals And Their Importance To Stakeholders Principles Of Accounting Volume 1 Financial Accounting

What Is Cash Receipts Journal Cash Payment Journal

Cash Receipt Accountingtools Simple Accounting Org

Cash Receipts Journal Double Entry Bookkeeping

Cash Receipts Journal Fundsnet

Post A Cash Receipts Journal To A General Ledger Simple Accounting Org

Cash Receipts Journal 40 Accounting Instruction Help How To Financial Managerial

Cash Receipts Journal Worksheet Youtube

Cash Receipts Journal Fundsnet

Cash Receipts Journal 40 Accounting Instruction Help How To Financial Managerial

Comments

Post a Comment